The Dow Jones Industrial Average has pieced together back-to-back record closes, but there are still opportunities to find stocks in the index at a relative bargain with an attractive yield, CNBC's Jim Cramer said Tuesday.

That is the case with the new Dow Chemical, Verizon and Walgreens Boots Alliance, the "Mad Money" host said.

Referencing technical analysis from Dan Fitzpatrick, Cramer said buying the stocks of these three companies would be particularly wise because the Dow is likely to continue its breakout and go higher.

"And when you get this kind of breakout, Fitzpatrick says you want to buy as early in the process as possible," Cramer said.

The analysis of the Dow from Fitzpatrick, who founded StockMarketMentor.com, suggests it has moved out of the symmetrical triangle pattern it has been in since its July highs.

The Dow had been "making a series of lower highs and higher lows," Cramer said. "This is called a classic continuation pattern, meaning that the Dow was merely resting before resuming its long march higher."

How much higher? Fitzpatrick thinks it could reach 29,000, Cramer said.

"Oh, boy, that's an extremely bullish forecast, but it makes sense to me now that we've taken the recession fears off the table and the Fed is very much our friend," Cramer said.

That forecast could be realized on the backs of Walgreens Boots Alliance, Dow Chemical and Verizon, Fitzpatrick's analysis shows.

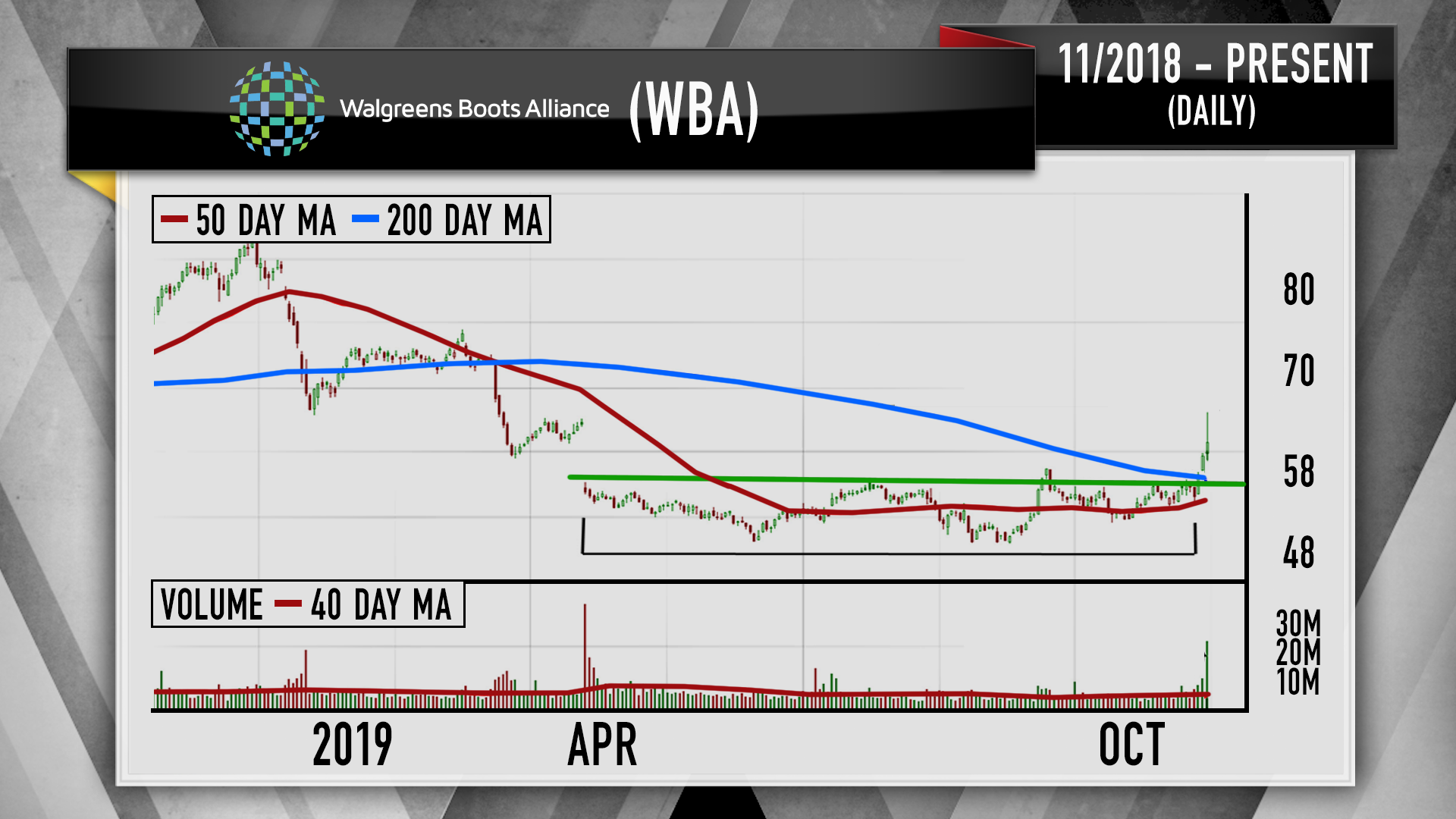

Walgreens Boots Alliance

Walgreens, with its nearly 3% yield, represents a buying opportunity, even before the news that it could be taken private, Cramer said. The stock rose 2.6% Tuesday to $61.21 on the reports.

But prior to that, Fitzpatrick's analysis still uncovered a promising trajectory for Walgreen's stock, Cramer said.

After seven months of trading in a tight range, Walgreen's 50-day moving average is trending higher, and while its 200-day moving average hasn't yet followed suit, Fitzpatrick thinks that will change soon, Cramer said.

In the next few weeks, Fitzpatrick anticipates a "bullish crossover" occurring, in which the "short-term 50-day moving average goes above the longer-term 200. That is a classic sign that the stock is on the mend," Cramer said.

Fitzpatrick sees Walgreens' stock reaching around $70, which is about 12.5% higher than its current price, Cramer said.

But the "golden cross" that Fitzpatrick anticipates occurring signals the stock is worth buying hand over fist, Cramer said.

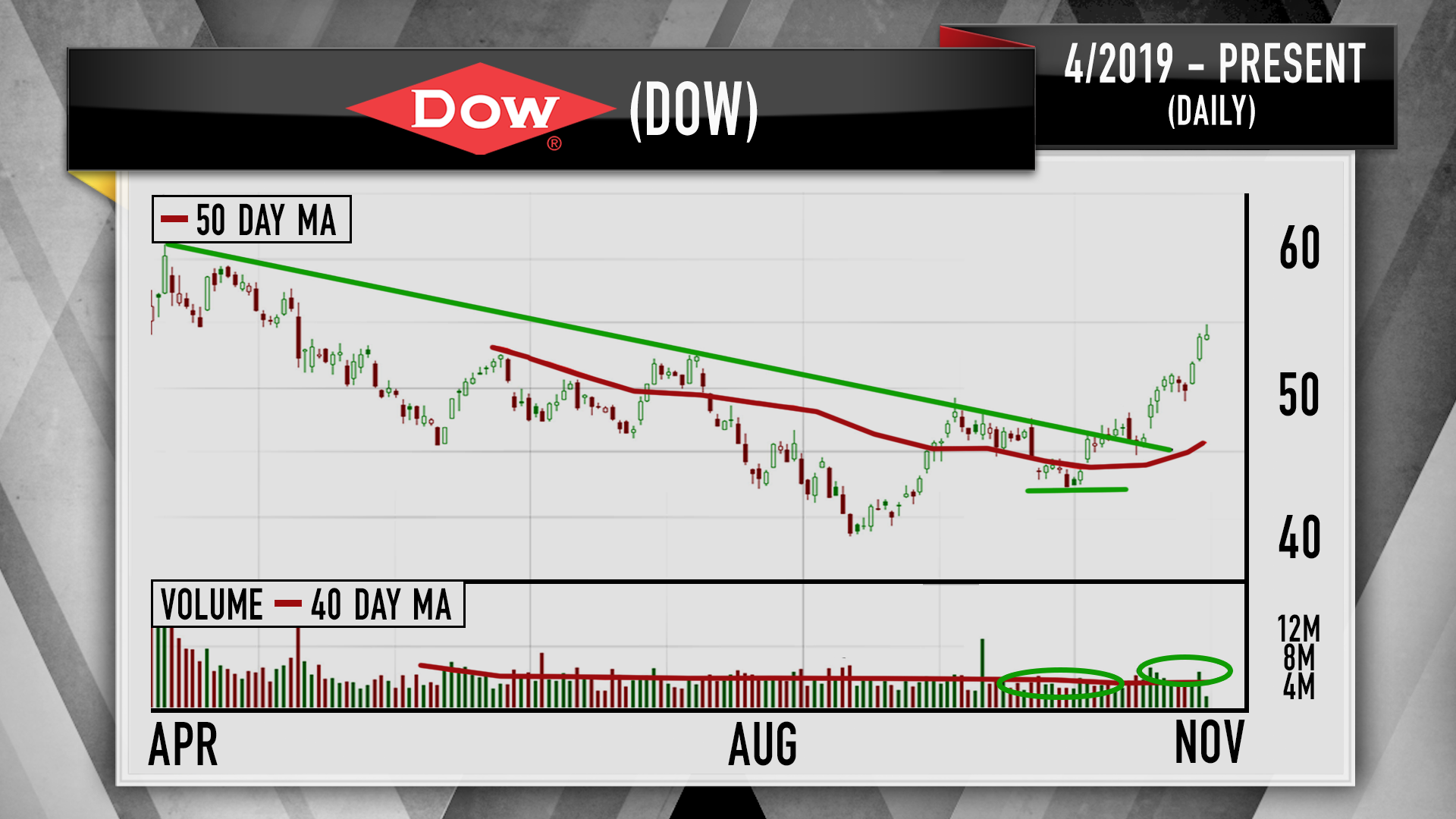

Dow Inc.

Spun off from DowDuPont in April, Dow Inc. lost about 33% of its market capitalization in the ensuing months.

It ultimately reached a bottom around $40 toward the end of August, Cramer said, but Fitzpatrick's analysis shows institutional money managers have been increasingly purchasing the stock.

"You can tell because it tends to rally on strong volume and decline on weak volume," Cramer said.

Dow closed around $54 on Tuesday, and while Fitzpatrick thinks it is slightly "overextended" at the moment, Cramer said the technical analyst recommends buying Dow into any weakness, particularly since the company offers a 5.2% yield.

For his part, Cramer said he thinks Dow has room to go higher.

"I'm kicking myself that we sold this one for the charitable trust," Cramer said. "This thing is now a juggernaut, and it's a juggernaut because of the possibility that business is going to get better in this country."

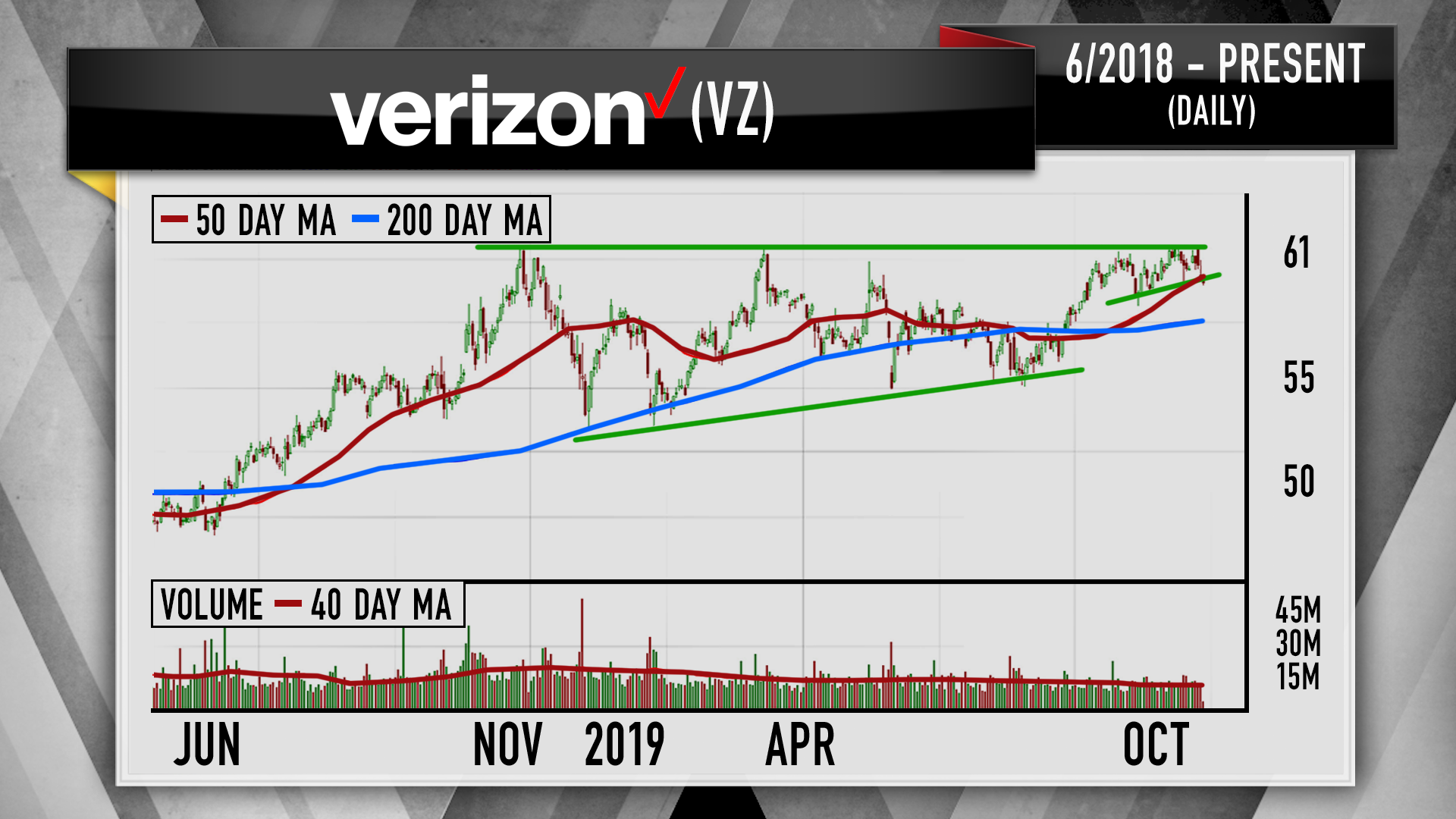

Verizon

Verizon, which has a dividend yield above $4, also has experienced a months-long stretch of trading within a tight range, between the low $60s and low $50s.

The stock has created a series of higher lows for almost a year, establishing what is called a "flat triangle pattern," Cramer said.

But, more recently, Cramer said the stock has shown a smaller flat triangle, "with the floor of the formation at roughly $59." It closed Tuesday at $59.50.

"This is what's known as a fractal: where you have a smaller version of a pattern tucked inside a larger version of the pattern," Cramer said. "And Fitz says fractal formations can be very powerful if you trade them correctly."

In Fitzpatrick's view, the correct way to handle Verizon right now is to wait until the stock breaks above $61.

When that happens, "that's when you'll know that the leg is really going to be starting," Cramer said. "From $61, he expects it will be smooth sailing to $70 based on the length and depth of the consolidation pattern that Verizon is currently stuck in."

0 Comments